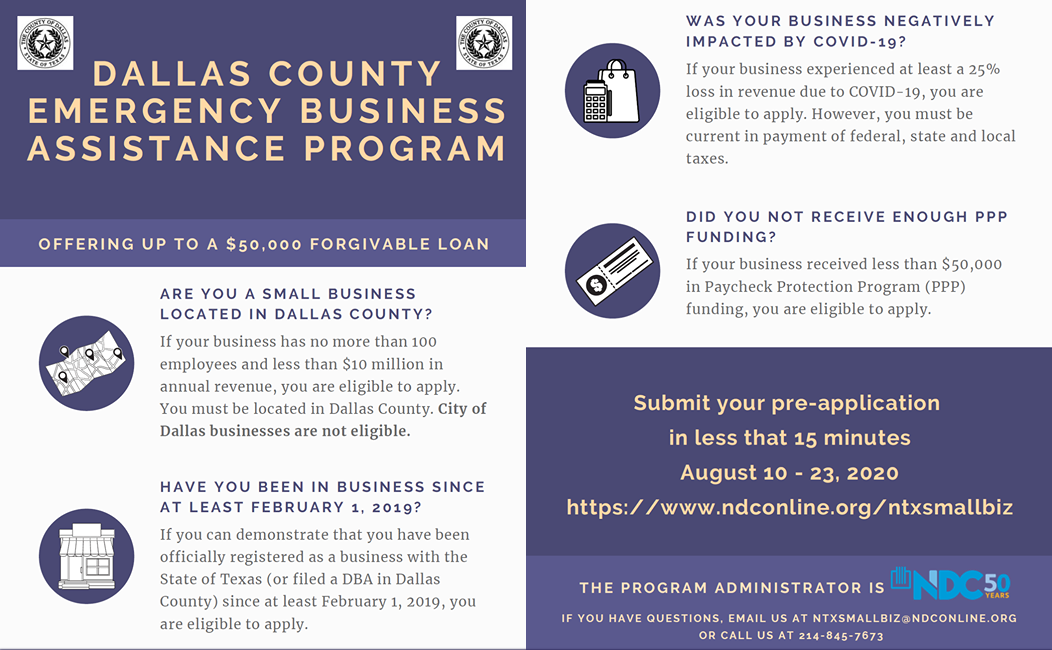

Preapplication Dates: The pre-application will open on August 10, 2020 and close on August 23, 2020.

Link to the Pre-Application: www.surveymonkey.com/r/ebap3

EBAP Loan Calculator

Funding: $35 million of Coronavirus Relief Fund funding (as provided by the CARES Act)

Definition of small business: Business with no more than 100 employees and revenue under $10 million.

Other eligibility requirements: Business must be located in Dallas County (but not the City of Dallas). Business must have experienced a loss of at least 25% in income since March 1, 2020 because of the pandemic. Business must be current in the payment of county and local taxes. Business cannot have received more than $50,000 from the Paycheck Protection Program.

Type of assistance: Forgivable loan

Maximum loan amount: $50,000

Maximum loan calculation: 3 months of payroll, lease payments, utilities, the renting of existing equipment, & the payment of existing business-related loans for equipment, vehicles, and/or real estate + $3000 of restart-up capital.

Loan terms: Loan will have a term of 1 year and an annual interest rate of 1%. No interest accrues and no payments are required until month 5.

Eligibility for forgiveness: The original principal amount is eligible for forgiveness upon Lender’s receipt of documentation that Borrower continued to operate its business for four (4) months and carried at least 60% of the March 1, 2020 full-time employee count and payroll. Each month that Borrower continues to be in operation and maintain the required employee count and payroll, one fourth (¼) of the loan is eligible for forgiveness by Lender.

Excluded businesses: Non-profit entities, franchises, businesses whose primary income is derived from rental/income producing properties, businesses that operate as an age-restricted business. Also excluded are employees of Dallas County, persons/entities who are a party to a lawsuit against the County, and persons/entities who have been a party to a contract with Dallas County that has been terminated in the past 13 months because of insufficient performance. Businesses located in the City of Dallas are not eligible since the City of Dallas is operating its own loan fund. Businesses cannot have received more than $50,000 of Paycheck Protection Program assistance.

Prioritization of Funds: 40% of total funding will be reserved for businesses with <50 employees, 40% of total funding will be reserved for businesses with 50-100 employees, and the remaining 20% of total funding will be reserved for businesses located in areas designated as Priority and Strategic areas by Dallas County.

Status of program:

Round 3: IN PROGRESS. The pre-application period opens on August 10, 2020 and closes on August 23, 2020. After the pre-application period closes, NDC will conduct a randomized borrower selection process to identify the eligible businesses that will be invited to submit a full loan application.

Round 2: The pre-application period closed on July 26, 2020. NDC is in the process of identifying which businesses are eligible to submit a full loan application.

Round 1: Selected businesses were invited to submit a full loan application on July 10, 2020.

Email: [email protected]

Phone number: (214) 845-7673. All voicemail messages will be returned within one business day.